Overview

The following guidance is provided by the Tax Office to assist UA employees and departments in understanding the tax treatment of various fringe benefits, as well as the reporting and withholding rules that UA must follow as the employer.

This page does not address standard benefits eligibility for UA employees/dependents. For this information, please see the Human Resources – Benefits website http://hr.ua.edu/benefits

The Tax Office cannot give personal tax advice. For specific concerns/questions relative to your individual tax situation, you should consult your personal tax accountant or advisor.

In general, a fringe benefit is any property or service that an employee (including certain independent contractors) receives in lieu of, or in addition to, regular compensation. Fringe benefits can take many forms. Examples include (but are not limited to) such items as gift certificates, athletic tickets, certain club memberships, spouse/companion travel, automobiles, housing, meals, awards or prizes.

The guidance below will discuss the general rules, as well as many common situations encountered at UA. References to the Internal Revenue Code (IRC) and Treasury Regulations (Reg.) are provided, along with other IRS guidance that may be helpful. However, the information is not intended to be all-inclusive. For new or unique situations, please contact the Tax Office to ensure that the appropriate tax treatment is applied.

Taxability of Fringe Benefits

Fringe benefits are taxable, unless excluded by law. IRC §61; Reg. §1.61-21

The following publications address the IRS’ approach to fringe benefits:

IRS Pub. 15-B Employer’s Tax Guide to Fringe Benefits

IRS Pub. 5137 Fringe Benefit Guide

For a fringe benefit to be taxable, it need not be furnished directly to the employee by the institution, as long as the benefit is provided in connection with the performance of services for the institution. A fringe benefit may be taxable to a person even though the person did not actually receive it. Reg. §1.61-21(a)(4)

EXAMPLE: A benefit provided to an employee’s spouse or child will be treated as a benefit to the employee.

A fringe benefit provided by a third party will be subject to tax reporting by the University, if the benefit was part of the employee’s contract or was provided through an arrangement with the University. Reg. §1.61-21(a)(5); IRS Announcement 94-112

EXAMPLE: An automobile dealer provides a vehicle for use by a UA employee, through an arrangement with the UA athletic department. UA is responsible for taxing the employee on personal use of the vehicle and reporting the value on the employee’s W-2. In contrast, if the dealer provided the vehicle to promote its own business interests, and UA was not involved in the arrangement, the treatment would be different. Although the employee may have income tax consequences, UA would have no reporting responsibility for the vehicle.

Valuation

The general valuation rule applies to most fringe benefits. Under this rule, the value of a fringe benefit is its fair market value (FMV). This is the amount an individual would have to pay a third party in an arm’s-length transaction to buy or lease the benefit.

Neither the employee’s subjective perception of the value, nor the employer’s cost, determines the FMV of the benefit. Reg. §1.61-21(b)(2)

In many cases, the cost and FMV are the same; however, there are also situations in which FMV and cost differ, such as when the employer incurs a cost less than the value to provide the benefit.

EXAMPLE: An employee is allowed to stay in University-owned housing for free. The value of the housing is a benefit to the employee even though there is no payment involved.

Special valuation rules apply for certain fringe benefits. These rules are covered in sections pertaining to specific benefits.

Tax Withholding and Reporting

Taxable fringe benefits for employees will be reported as taxable wages on IRS Form W-2. Most taxable fringes are subject to federal and state income tax withholding, as well as social security and Medicare taxes. The tax withholding on fringe benefits may be spread over multiple pay periods during the tax year. Benefits provided in the last two months of the year, may have taxation carried into the following year. Specific withholding rules may apply to certain fringes, as discussed separately.

Taxable fringes for non-employees are not subject to tax withholding, but may be reportable on IRS Form 1099-MISC.

Processing

Due to the many types and methods of providing fringe benefits, an important aspect of tax compliance is the tracking of fringes as they occur. Specific processes may apply to certain fringes, as discussed separately. For all other fringes, we ask that departments use the Taxable Fringe Reporting Form to submit information to the Tax Office, at the time you are making arrangements for the benefit to be provided. On this form, you will be asked to provide the employee’s name, CWID, and a description of what is being provided. Email the form to payrolltax@ua.edu. The Tax Analyst will contact you to confirm receipt of the information and to follow up with any questions.

EXAMPLE: Your department will be providing temporary housing for a new employee. At the time you are making arrangements for the housing – whether it is a hotel, apartment, or on-campus housing – please complete the Taxable Fringe Reporting Form and submit to the Tax Office. Include as much information as you have, even if you have to estimate when the temporary housing will end.

EXAMPLE: You are purchasing gift certificates which will be awarded to several employees for their outstanding performance. Complete the Taxable Fringe Reporting Form with the listing of employees/CWID numbers and value of gift certificates. Submit the form to the Tax Office, and also include a copy of the form as an attachment when you submit your payment documentation.

If you have questions about the tax treatment of a particular type of fringe benefit, please contact the Tax Office at payrolltax@ua.edu.

Exclusions from Taxation

Internal Revenue Code section 132 provides four general provisions that may apply to exclude fringe benefits from taxation. See below for a brief description of each.

No-Additional-Cost Service Exclusion – IRC §132(b); Reg. §1.132-2

A free or reduced charge service provided to employees is excludable from income as a no-additional-cost service if:

- the service is offered for sale to students/customers in the ordinary course of the University’s business, and

- the University does not incur substantial additional expense, including foregone revenue, in providing the service to the employee. This means that the service is being provided at an excess capacity, and the use by an employee does not displace other customers.

EXAMPLE:

- employee membership/use of university recreation facilities

For purposes of the no-additional-cost services exclusion, the term “employee” includes the following: Reg. §1.132-1(b)(1)

- a current employee

- the employee’s spouse

- the employee’s dependent child

- a former employee who retired or left on disability

- a widow(er) of an individual who died while employed

No-additional-cost benefits made available only to highly compensated employees are not excludable. Reg. §1.132-8

Qualified Employee Discount Exclusion – IRC §132(c); Reg. §1.132-3

An employee is not required to include in gross income any qualified discount received from the University on property or services that the University offers for sale to students/customers in the ordinary course of business, as long as the discount does not exceed:

- In the case of services, 20% of the price at which a service is offered to customers

- In the case of property, the gross profit % multiplied by the price at which property is offered to customers in the ordinary course of business. This means that the property can’t be discounted below cost.

Any excess discount would be treated as taxable income.

EXAMPLES:

- Athletic tickets – employee discount is 20% off the face value of ticket.

- Supply Store – employee discount is 20% everyday, 30% for certain special promotions. These discounts do not exceed the gross profit percentage, which is typically 30%.

The qualified employee discount exclusion does not apply to property or services that are offered for sale primarily to employees and their families (such as merchandise sold at an employee store or through an employer-provided catalog service). Reg. §1.132-3(a)(2)

For purposes of the qualified employee discount exclusion, the term “employee” includes the following: Reg. §1.132-1(b)(1)

- a current employee

- the employee’s spouse

- the employee’s dependent child

- a former employee who retired or left on disability

- a widow(er) of an individual who died while employed

To qualify for exclusion, the discount must not discriminate in favor of highly compensated employees. Reg. §1.132-3(a)(6)

Working Condition Fringe Exclusion – IRC §132(d); Reg. §1.132-5

Working condition fringes are generally defined as any property or services provided by an employer that, if paid by the employee, would be deductible as a trade or business expense under IRC §§ 162 or 167. The value of a working condition fringe benefit is excludable from an employee’s income.

To be excludable as a working condition fringe benefit, all of the following must apply:

- the benefit must relate to the employer’s business,

- the employee would have been entitled to an income tax deduction if expense had been paid personally, and

- the business use must be substantiated with records.

EXAMPLES:

- business use of vehicle

- job-related education/training

For purposes of the working condition fringe benefit exclusion, the following are considered “employees”: Reg. §1.132-1(b)(2) and 1.132-5(r)

- Current employees

- Board of directors of the employer

- Independent contractors

- Volunteers

De Minimis Fringe Exclusion – IRC §132(e); Reg. §1.132-6

A fringe benefit qualifies for exclusion as a de minimis (minimal) fringe benefit if its value is so small that, considering the frequency with which it is provided, accounting for it would be unreasonable or impractical.

EXAMPLES of items that may be excludable as de minimis, if they are infrequent, not routine, include:

- occasional coffee, soft drinks and snack items furnished to employees

- occasional parties, group meals, or picnics for employees and their guests

- occasional theater or sporting event tickets (not season tickets)

- traditional holiday gifts of property (not cash) with a low fair market value

- flowers, fruit, books, or similar items provided under special circumstances

EXAMPLES of fringe benefits that are not excludable as de minimis:

- season tickets to sporting or theatrical events

- commuting use of an employer-provided automobile more than one day a month

- membership in a private country club

- use of employer-owned or leased facilities (such as an apartment, hunting lodge, boat, etc.) for a weekend

Cash or cash equivalents (gift certificates, gift cards, etc.) do NOT qualify as de minimis, no matter how small the amount.

For purposes of the de minimis exclusion, the term “employee” means any recipient of a fringe benefit. Reg. §1.132-1(b)(4)

NOTE: The various examples listed are from the tax regulations, and are provided for tax purposes only. This does NOT imply that any or all of these items would be allowable using University funds. Refer to Accounts Payable for guidance on allowable expenditures, funding sources, etc.

Fringe Benefit Taxation – Specific Areas

In addition to the general rules for taxability and exclusion described above, specific tax rules apply to certain types of fringe benefits. Some of the fringe benefits commonly seen at UA are discussed below. The following is not an all-inclusive list, and does not address whether or not an employee is eligible to receive a particular fringe benefit. Some of the benefits listed may be campus-wide, while others may be specific to certain departments.

Aircraft

The value of flights taken by an employee for personal purposes on an institution-owned or chartered aircraft must be included in the employee’s income. Reg. §1.61-21

Similarly, if family members or friends of the employee use an aircraft for personal purposes, the value of such use will be included in the employee’s gross income. The value is determined by special aircraft valuation formulas. Reg. §1.61-21(g)

Non-commercial flight valuation rule – Reg. §1.61-21(g)

The value of a flight is determined under the Standard Industry Fare Level formula (SIFL) by:

- multiplying the SIFL cents-per-mile rates

- by the appropriate aircraft multiple and then

- adding the applicable terminal charge.

The SIFL cents-per-mile rates and the terminal charge are calculated by the Department of Transportation and are reviewed semi-annually. Aircraft multiples for control and non-control employees are provided in Reg. §1.61-21(g)(7).

The value of a flight is determined on a per flight basis (a round-trip is comprised of at least two flights), and is measured by the distance (in statute miles) between the place where the individual boards the aircraft and the place at which such individual deplanes.

EXAMPLE: An employee who takes a trip from Los Angeles to Texas, then Texas to Alabama, and finally Alabama to Georgia has taken three flights and must apply the valuation rule to each flight.

Control Employees are required to use the higher aircraft multiples. For purposes of the aircraft multiples, a “control employee” for a government employer is any:

- elected official or

- employee whose compensation is at least as great as a Federal government employee at Executive Level V.

For 2024, this amount is $180,000. Annual updates can be found by going to the OPM.gov website .

Seating Capacity Rule – Reg. §1.61-21(g)(12)

If fifty (50) percent or more of the regular passenger seating capacity of an aircraft is occupied by individuals whose flights are primarily for the employer’s business, then the value of travel by employees, spouses, and dependents is deemed zero (0). This rule must be met both at the time the individual boards the aircraft and at the time the individual deplanes the aircraft.

Regardless of whether the seating capacity rule has been met, the value of flights taken by individuals who are not considered employees is not excludable from gross income. The SIFL value of travel by non-employees is calculated using the non-control employee rates. For purposes of the seating capacity rule, an “employee” includes:

- any individual who was formerly employed and who separated from service by reason of retirement or disability,

- any widow(er) of any individual who dies while employed,

- a spouse,

- a dependent child, and

- parents of the employee. IRC §132(h)

The phrase “employee” does not include independent contractors or directors.

Processing

The department responsible party should communicate with the Tax Office on a regular basis to provide necessary information as flights occur. The Tax Office will assist in calculating the taxable value by obtaining current SIFL rates, providing an up-to-date template for calculation, analyzing charter flight manifests, etc. Once taxable values are determined, the Tax Office will include this information in the file which is transmitted to Payroll on a monthly basis for tax withholding purposes.

Automobiles

Personal use of a University vehicle is considered a taxable fringe benefit to the employee. University vehicles include any vehicles leased, owned or insured by the University. Courtesy cars provided to athletic department coaches and staff are generally treated as University vehicles for tax purposes.

Personal Use

Personal use of a UA vehicle is defined as all use that is not for official University business. For example:

- Commuting between residence and work station (see section on Commuting for additional details)

- Vacation or weekend use

- Use by spouse and/or dependents

EXAMPLE: An employee goes into his office on the weekend, because of an urgent meeting. The commuting to his office is personal use, regardless of whether it is required by his employer. Any reimbursement for the commuting expense is taxable wages. Reg. §1.162-2(e)

De Minimis Nontaxable Personal Use

An exception to the limitation on personal use applies for use that qualifies as de minimis. Examples of de minimis use of an employer-provided vehicle that can be excludable include:

- Small personal detour while on business, such as driving to lunch while out of the office on business.

- Infrequent (not more than one day per month) commuting in employer vehicle. This does not mean that an employee can receive an excludable reimbursement for commuting 12 days a year. This rule is available to cover infrequent, occasional situations. Reg. §§ 1.132-6(e)(2) & 1.132-6(d)(3)

Business Use Substantiation

Properly substantiated employment-connected business mileage is a working condition fringe benefit, not taxable to the employee. Reg. §1.132-5

Under the strict substantiation requirements of IRC §274, the employee must keep detailed records to support business mileage. See “Mileage Log” below.

However, there are three possible exceptions from the mileage log requirements, as follows:

- Vehicle not used for personal purposes

- Qualified nonpersonal use vehicle

- Commuting valuation rule

Vehicle not used for personal purposes – Reg. §1.274-6T(a)(2)

A vehicle used 100% for business will satisfy the substantiation rules under IRC §274(d), if a written policy prohibiting personal use is implemented and all of the following conditions are met:

- The vehicle is owned or leased by the employer and is provided to one or more employees for use in connection with the employer’s trade or business.

- When the vehicle is not used in the employer’s trade or business, it is kept on the employer’s business premises, unless it is temporarily located elsewhere, for example, for maintenance or because of a mechanical failure.

- The vehicle may not be used for personal purposes, except for de minimis personal use (such as a stop for lunch between two business deliveries).

EXAMPLE:A UA fleet vehicle (“state car”) is assigned to a particular UA department, for use by department employees on official UA business. The car remains on UA premises when not in use, and is not driven home for commuting purposes. The only personal use is de minimis, such as a lunch stop between business locations. It is not necessary for employees to keep detailed mileage logs in this case, because all of the use is business and there is no personal use to allocate.

Qualified Nonpersonal Use Vehicle – Reg. §1.274-5(k)

All of an employee’s use of a qualified nonpersonal use vehicle is a working condition fringe benefit and is excludable from the taxable wages of an employee. Therefore, it is not necessary to keep mileage logs on these vehicles. Some examples include:

- clearly marked police, fire, and public safety officer vehicles

- unmarked vehicle used by law enforcement officers if the use is officially authorized

- any vehicle designed to carry a cargo with a loaded gross vehicle weight over 14,000 pounds

- specially modified work trucks or vans

For a detailed listing of qualified nonpersonal use vehicles, see IRS Publication 15-B.

Commuting Valuation Rule – Reg. §1.61-21(f)

Commuting is considered personal mileage, even if the employer requires the employee to take the vehicle home. Under the commuting valuation rule, the value of the employer provided vehicle is $1.50 per one-way commute, $3.00 round trip. The commuting valuation rule can only be used if all of the following apply:

- The vehicle is owned or leased by the university, provided for use in connection with university business, and is used for university business only;

- The employee is required to commute in the vehicle for a valid non-compensatory business reason. The employee is required to commute in the vehicle for the benefit of the employer and the reason must be identifiable, justifiable, and documented. The use cannot be voluntary.

- The university department has a written policy prohibiting personal use other than commuting, or de minimis personal use (such as a stop for a personal errand that is between work and the employee’s home),

- The university department reasonably believes that, except for de minimis personal use, the employee does not use the vehicle for any personal purpose other than commuting and;

- The employee required to use the vehicle for commuting is not considered a control employee of the university. For this purpose, a control employee of a government employer is any elected official or employee whose compensation is at least as great as a Federal government employee at Executive Level V.

For 2024, this amount is $180,000. Annual updates can be found by going to the OPM.gov website.

If all of the above apply, the employee would not be required to keep detailed mileage logs to support business mileage; instead, the employee would only need to track the number of commuting trips made.

If you believe you may qualify to use the commuting valuation rule, please contact the Tax Office for review and assistance with appropriate departmental policies and documentation.

For commuting situations where the above requirements are not met, or where other personal use of the vehicle is allowed, then the annual lease value rule will be used to determine taxable value, as described below.

Annual Lease Value Rule – Reg. §1.61-21(d)

Under the annual lease value rule, the following steps are used to calculate taxable value:

1. Determine the fair market value (FMV) of the vehicle on the first day it is provided to the employee.

- The safe harbor value of an automobile owned by the employer is the employer’s cost of buying it (including sales tax, title and other expenses attributable to the purchase), provided that the purchase is made at arm’s length.

- The safe harbor value of an automobile leased by the employer can be any of the following:

- the manufacturer’s suggested retail price less 8%

- the retail value of the automobile as reported in a nationally recognized pricing source

- the manufacturer’s invoice price plus 4%

2. Use the FMV to determine the annual lease value (ALV) per the table in IRS Publication 15-B, which is based on a 4-year lease term. The ALV includes maintenance and insurance, but not fuel.

3. Add the fair market value of fuel the employer provides or 5 cents per mile driven to the ALV.

4. Multiply the resulting value by the percentage of personal miles out of total miles driven by the employee.

EXAMPLE: FMV of the vehicle provided to Employee ‘A’ is $34,500. The ALV of the vehicle is $9,250 per the IRS annual lease value table.

Total miles driven: 15,000

Personal miles: 10,000

Business miles: 5,000

- 10,000 personal miles/15,000 total miles = .66 personal usage

- 15,000 miles x .055 fuel cost/mile = $825 total fuel provided

- $9,250 ALV + $825 fuel = $10,075 total value made available to the employee

- $10,075 total value x .66 personal usage = $6,650 personal benefit, taxable to Employee ‘A’

NOTE: If the vehicle is available to the employee for only part of the year, the lease value will be prorated based on the number of days of availability.

Mileage Log

Employees using a UA vehicle under the annual lease value rule must keep a daily travel log that contains the following:

- Date

- Beginning location

- Ending location

- Beginning mileage

- Ending mileage

- Mileage per trip

- Business purpose of trip

Employees may use the Sample Mileage Log for this purpose, or they may use another format, app, etc. as long as it contains all necessary information items.

If an employee does not keep mileage records, then the entire lease value, plus fuel, if applicable, is taxable to the employee. The employee may be able to take itemized deductions for any substantiated business use on Form 1040, Schedule A. Reg. §1.132-5(b)

Processing

Based on information provided by the employee, the Tax Office will calculate the personal value of the UA provided vehicle. This amount will be added to the employee’s taxable wages and reported on Form W-2. Social Security tax, if applicable, and Medicare tax will be withheld. Per IRS Announcement 85-113, employers may elect not to withhold income taxes on the value of an employee’s personal use of an employer-provided vehicle; therefore, federal and state income taxes will not be withheld.

The following reporting periods will be used:

Athletics department courtesy vehicles – semi-annual basis

Usage Dec 1 – May 31 Taxed in June

Usage Jun 1 – Nov 30 Taxed in December

All other areas – annual basis

Usage Dec 1 – Nov 30 Taxed in December

Clothing

Clothing expenses and allowances are taxable fringe benefits, unless an exclusion applies as outlined below.

Working Condition Fringe Exclusion – IRC §132(d); Reg. §1.132-5

Working condition fringes are generally defined as any property or services provided by an employer that, if paid by the employee, would be deductible as an ordinary and necessary business expense under IRC §§ 162 or 167.

The Tax Court has established three criteria for the cost of clothing to be considered an ordinary and necessary business expense: TC Memo 2016-79

- the clothing is required or essential in the individual’s employment;

- the clothing is not suitable for general or personal wear; and

- the clothing is not so worn.

An employer’s expense, direct or through reimbursement, in providing employee uniforms that meet the above criteria is considered a working-condition fringe benefit, and is not includable in employee wages.

EXAMPLES of clothing items that may be excluded as working condition fringes:

- Uniforms worn by police officers, health care professionals, delivery workers, letter carriers, transportation workers; chef’s coats; certain athletic uniforms.

- Protective clothing such as safety glasses, hard-hats, work gloves, steel-toed work boots, and other clothing required by OSHA regulations.

- Uniform/clothing that is rented and/or returned to the university and is maintained in a central area where the clothing is issued to the employee. The clothing must be kept and cleaned on university property and reissued on a regular basis. The employee may not assume personal possession of the clothing.

De Minimis Fringe Exclusion – IRC §132(e); Reg. §1.132-6

De minimis fringe benefits are benefits in which the value is so small in relation to the frequency in which it is provided, that accounting for it is unreasonable or administratively impracticable. For purposes of the de minimis exclusion, the term “employee” means any recipient of a fringe benefit. Reg. § 1.132-1(b)(4)

For UA’s purposes, clothing items of nominal value ($100 or less) provided infrequently (no more than two times per year) may be excluded from taxation as a de minimis fringe benefit.

If either the value or frequency limits are exceeded, the entire value of the benefit (not just the excess amount) is taxable. Reg. §1.132-6 (d)(4)

EXAMPLES of clothing items that may be excluded as de minimis fringes:

- Low-value clothing bearing the University or department name, such as facilities services (maintenance) uniforms. These uniforms typically have a matching shirt and pant.

- T-shirts provided to employees to wear to promote a campus event

An apparel allowance, or the value of merchandise credit provided to certain employees that allows them to acquire apparel and goods directly from an outside vendor, is a taxable fringe benefit.

Processing

If your department provides clothing to employees that is taxable per the above guidance, please use the Taxable Fringe Reporting Form to notify the Tax Office promptly, so that tax withholding can be processed in a timely manner.

If any questions arise regarding the exclusion (or inclusion) of clothing in an employee’s taxable wages, please contact the Tax Office at payrolltax@ua.edu for review and assistance.

Club Memberships and Dues

For this section, the term “club” refers to those clubs organized for business, pleasure, recreation, or other social purpose. Examples include country clubs, golf and athletic clubs, airline clubs, hotel clubs, and clubs operated to provide meals under circumstances generally considered to be conducive to business discussion. Reg. §1.274-2(a)(2)(iii)(a)

EXAMPLES: NorthRiver Yacht Club, Indian Hills Country Club

Club memberships and dues are not allowed as business deductions. If an employer pays, reimburses, or otherwise provides these benefits for an employee, the entire value is taxable to the employee. IRC §274(a)(3)

The Tax Cuts and Jobs Act eliminated the potential to allocate any portion of club memberships/dues for business purposes. IRC §274(a)(2)(c) – repealed

Due to this federal law change, the University of Alabama has adopted a club membership allowance policy. The University or its foundations will no longer pay social club dues or initiation fees directly to the club. If a department wishes to pay for an employee’s membership in a social club, this will be paid to the employee as a taxable allowance. The club allowance will be processed through Payroll using an ePA, subject to federal, state, and FICA tax withholdings. The employee is responsible for paying the club directly.

Initiation Fee – This one-time payment will be processed through Payroll using an ePA, subject to federal, state, and FICA tax withholdings on the supplemental payroll. A copy of the employee’s offer letter and evidence of the initiation fee amount should be submitted as documentation.

Monthly Dues – A monthly social club allowance is intended to help defray the monthly dues that the employee pays to the club. The allowance will be processed through Payroll using an ePA with applicable taxes withheld on the regular paychecks.

Business Entertainment Charges – If an employee incurs a business expense at the club, such as a business entertainment meal, s/he should pay this charge as part of the monthly statement. Then, s/he may request reimbursement using a Concur Expense Report. Appropriate substantiation of the business purpose must be included. For the reimbursement to be nontaxable, the expense report must be submitted within 60 days of the expenditure. For more information, please visit the following websites:

- Tax Office – Fringe Benefit Taxation, Expense Reimbursements: https://taxoffice.ua.edu/fringe-benefit-taxation/#ExpenseReimb

- A/P Spending Policy, Section 2.0 Submitting Expense Reports and Payment Requests: http://accountspayable.ua.edu/spending-policy/#Requests

- A/P Spending Policy, Section 6.0 Entertainment: http://accountspayable.ua.edu/spending-policy/#Entertainment

- Concur: https://concur.ua.edu/

Other Memberships

The following organizations are not treated as “clubs”: professional organizations, business leagues, trade associations, chambers of commerce, boards of trade, real estate boards, and civic or public service organizations. Reg. §1.274-2(a)(2)(iii)(b)

For guidance regarding these types of memberships, refer to the A/P Spending Policy, Section 11.0 Memberships. http://accountspayable.ua.edu/spending-policy/#Memberships

Questions?

Questions about the reimbursement of business entertainment charges should be directed to Accounts Payable at acctspay@ua.edu or 348-7377.

Questions about the processing of club membership allowances through Payroll should be directed to Human Resources at hrsvctr@ua.edu or 348-7732.

If you have any questions about the taxability of club membership allowances, please contact the Tax Office at payrolltax@ua.edu.

Commuting

“Commuting” refers to travel between an employee’s personal residence and main or regular place of work. Reimbursements for these expenses are taxable income to the employee. Reg. §§ 1.162-2(e) and 1.262-1(b)(5)

EXAMPLES of commuting situations, for which reimbursements are taxable and no deduction allowed:

- An employee drives from his residence to his principal or regular workplace(s) (during or after work hours, whether required or not by employer).

- An employee drives from her residence to her regular workplace on the weekend because of an urgent meeting convened by her employer.

It is important to distinguish commuting expenses from transportation expenses which may be excludable from income in the following situations:

- Daily transportation between one work location and another, neither one being the employee’s residence. IRC §162(a)(2)

- Daily transportation between the employee’s residence and a temporary work location outside the metropolitan area where the employee generally works. Revenue Ruling 99-7

- Daily transportation between the employee’s residence and a temporary work location in the same business (regardless of distance) if the employee has a regular work location away from the residence. Revenue Ruling 99-7

- Daily transportation between the employee’s residence and another work location in the same business, if the residence is the employee’s principal place of business (regardless of whether the other work location is regular or temporary and regardless of the distance). Revenue Ruling 99-7

Temporary work location defined

Employment at a work location that is expected to last (and does in fact last) for one (1) year or less, is considered temporary in the absence of facts and circumstances indicating otherwise. If the expectation regarding the time period of the job changes, the job will not be treated as temporary after such date.

EXAMPLE: An employee travels from his residence to a temporary work site for the day, driving past his official duty station on the way. Reimbursements for transportation between the residence and a temporary work site may be excludable to the extent of the actual distance traveled. ILM 199948018

Processing

If your department is reimbursing for mileage or other travel expenses that may be considered commuting under the above rules, please contact the Tax Office for review and assistance. You may submit information on the Taxable Fringe Reporting Form, or email your inquiry to payrolltax@ua.edu.

Educational Benefits

For information on employee/dependent eligibility for educational benefits, refer to the Human Resources Educational Benefit Policy.

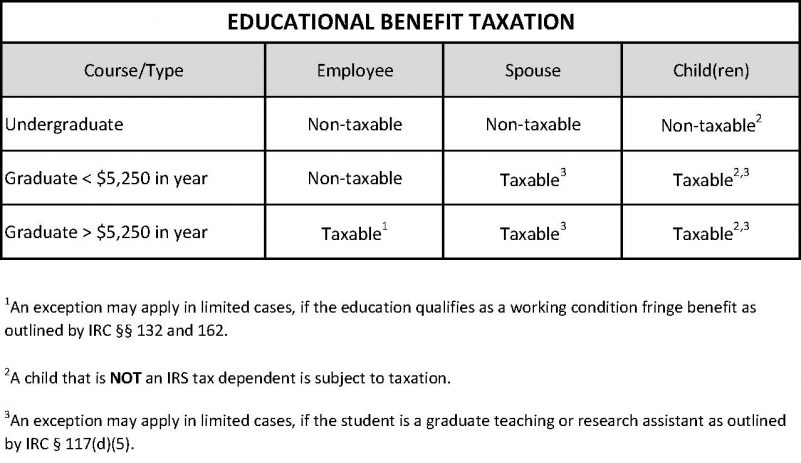

Educational benefits received by a University employee, his/her spouse, and/or child(ren) may be taxable to the employee. See chart below:

Educational Assistance Programs – IRC §127 (employee only)

The term “educational assistance” means the payment, by an employer, of expenses incurred by or on behalf of an employee for education of the employee (including, but not limited to, tuition, fees, and similar payments, books, supplies, and equipment). The maximum amount of educational assistance that an employee can receive tax-free during any calendar year is $5,250. The excess over this amount is includable in compensation and subject to tax withholding, unless another exclusion applies, such as the working condition fringe benefit. For purposes of this $5,250 limit, the employee must take into account all reimbursements received from employers for educational assistance, as well as the fair market value of all educational assistance paid or provided directly by the employer.

Working Condition Fringe Benefit – IRC §132(d) (employee only)

To qualify for the working condition fringe benefit exclusion as outlined by IRC §132(d), the educational benefit must:

- Be required by the employer or the law to keep the employee’s present salary, status, or job AND serve a bona fide business purpose for the employer; OR

- Maintain or improve skills needed for the employee’s current job.

Even if one of the above criteria has been met, the benefits may not be excluded from taxable income, if such benefits are:

- Needed to meet the minimum educational requirements of the employee’s current job; OR

- Part of a program of study that will qualify the individual for a new trade or business, even if s/he has no plans to enter that trade or business.

IRC §§ 132 & 162; Reg. §1.162-5; IRS Publication 970 pages 59-65 “Qualifying Work-Related Education”

Tuition Reduction – IRC §117(d)

Tuition reductions provided by the University to eligible employees and/or dependents for undergraduate level education, will generally qualify as tax-free scholarships.

A tuition reduction for graduate level education will qualify for exclusion only if the student receiving the benefit is performing teaching or research activities for the University. IRC §117(d)(5)

IRS Tax Dependent

An “IRS tax dependent” is a biological, step, eligible foster, or adopted child of the employee. IRC §152(f)(1)

In addition to meeting the criteria outlined in the preceding sentence, the child must meet the following criteria as outlined in IRC §152(c):

- Be under age 19 as of the close of the calendar year in which the taxable year of the taxpayer begins OR a student under age 24 as of the close of such calendar year,

- Reside with the taxpayer for more than half the taxable year,

- Not have filed a joint return with spouse (other than only for a claim of refund), and

- Not have provided more than one-half of his/her own support.

Special Rule for Divorced Parents, etc.

For purposes of the exclusion outlined under IRC §117(d), if a child receives over one-half of his/her support during the year from his/her parents-

- Who are divorced or legally separated under a decree of divorce or separate maintenance,

- Who are separated under a written separation agreement, or

- Who live apart at all times during the last 6 months of the calendar year, and

- The child is in custody of 1 or both of the parents for more than half of the calendar year,

Then the child shall be treated as the dependent of both parents. IRC §§ 132(h)(2)(B) & 152(e)

A child is required to be an IRS tax dependent to receive the exclusion from taxation. For additional information on the IRS definition of tax dependent, refer to IRS Publication 501.

Processing

The Tax Office works with HR/Benefits and Student Account Services to track educational benefits provided to UA employees and dependents. The Tax Office determines the taxable portion and provides the information to Payroll for taxation. For those educational benefits which are taxable, Federal, State, and Social Security taxes will be withheld from the employee’s payroll checks at the end of each semester in which the educational benefit was received. Taxes will be withheld over four (4) pay periods for biweekly-paid employees and over two (2) pay periods for monthly-paid employees. The Tax Office will notify the employee by email in advance of the taxation.

For employee graduate education benefits over $5,250, the Tax Office will notify the employee by email that the limit has been exceeded, and inform of the upcoming taxation. If the employee believes that a working condition exclusion may apply, he/she may request a review by the Tax Office. Instructions for how to request a review will be explained in the email notification.

The above processes apply to educational benefits provided at The University of Alabama. If your department plans to pay tuition to another institution on behalf of a UA employee (or their spouse/dependent), please contact the Tax Office for review and assistance. You may use the Taxable Fringe Reporting Form, or email your inquiry to payrolltax@ua.edu.

Expense Reimbursements

“Gross income” includes all items of value received by the employee. When an employee receives a reimbursement from their employer for business expenses incurred, the reimbursement could be considered income unless it is made pursuant to an “accountable plan.” An “accountable plan” requires employees to substantiate all expenses and to repay any amounts received in excess of the documented expenses. Reg. §1.62-2(c)(2)

In order to qualify as an “accountable plan,” the following tests must be met:

- reimbursements can only be made for business expenses incurred by the employee in connection with the performance of the employee’s duties;

- the plan must require employees to substantiate their expenses within a reasonable period of time (60-day safe harbor*); and

- the plan must require employees to repay any reimbursements which exceed substantiated expenses within a reasonable period of time (120-day safe harbor*).

*Reg. §1.62-2(g)(2) provides “safe harbors” which can be used to ensure reasonableness.

If these tests are not met, the full amount of the reimbursement is included in the employee’s income, reported as wages on Form W-2, and subject to tax withholdings. Reg. §1.62-2(c)(5)

Employees should be sure to submit expense reports, along with all supporting documentation, within 60 days from when the expense was incurred (in the case of travel, within 60 days from end of trip). Expenses submitted after 60 days will be treated as taxable income.

When combining smaller instances into one expense report, employees are encouraged to submit at least once a month, to stay within the 60 days. (For example, mileage logs or multiple small out-of-pocket expenses)

Processing

Dates are tracked within the Accounts Payable (Concur) system, and reimbursements over 60 days will be reported to the Tax Office. This information is submitted to Payroll each month and the employee will have taxes deducted from a subsequent salary check.

Gifts, Prizes and Awards

CASH and cash equivalents, including gift cards, gift certificates, credit/debit cards, Bama Cash, etc. are considered taxable income to the employee regardless of the value.

EXAMPLE: The IRS has ruled that wellness program cash rewards or premium reimbursements must be treated as taxable wages. IRS Memorandum 201622031

NON-CASH gifts, prizes, and awards are generally considered taxable income to the employee unless they qualify to be excluded as either

- Employee achievement awards, or

- De minimis

Employee Achievement Awards – IRC §274(j)

An employee achievement award is defined as tangible personal property, which is:

- transferred to the employee for length of service achievement or safety achievement,

- awarded as part of a meaningful presentation, and

- awarded in such a manner that it does not create a significant likelihood of being disguised compensation.

An employee achievement award can be excluded from the employee’s income if the cost of the award does not exceed $400 ($1,600 in the case of a qualified plan award). A qualified plan award given is part of an established written plan or program of the taxpayer which does not discriminate in favor of highly compensated employees.

Length of Service Awards

An item is not considered as being provided for a length of service award, if the item is given during the employee’s first 5 years of employment. The length of service awards must be given at least five years apart to qualify as nontaxable. IRC §274(j)(4)(B)

Safety Achievement Awards

An item does not qualify as a safety award if more than 10 percent of the eligible employees of the employer receive the award during the taxable year, or such item is awarded to a manager, administrator, clerical employee, or other professional employee. If more than 10 percent of the employees receive safety awards, those awards presented to eligible employees before the 10 percent is exceeded are deemed to have received a nontaxable safety award. IRC §274(j)(4); Reg. §1.274-8

De Minimis – IRC §132(e); Reg. §1.132-6

To be excludable from an employee’s wages as de minimis, the item must be non-cash, of nominal value, and provided infrequently. For UA’s purposes, “nominal value” will generally be considered $100 or less. In addition, the frequency of presentations should be determined on an individual employee basis (no more than twice per year).

If an award exceeds either the value or frequency limitations for de minimis fringes, the entire award is included in the employee’s wages, not just the portion that exceeds the de minimis limits. Reg. §1.132-6(d)(4)

Retirement Gifts

Retirement gifts may be excluded from income as length of service awards (per above rules), or as de minimis fringe benefits (even if above nominal value).

EXAMPLE: Assume that an employer provides a gold watch to each employee who completes 25 years of service with the employer. The value of the gold watch is excluded from gross income as a de minimis fringe. If the employer provides a gold watch to an employee who has not completed lengthy service or on an occasion other than retirement, the value of the watch is not excludable as a de minimis fringe. Prop. Reg. §1.274-8(d)(2)

Awards Funded by Third Party

If funds for awards or prizes are provided by an outside party, the award is taxable in the same way as if provided directly by the employer. If the funds are turned over to the employer to select and distribute the awards, the employer is responsible for all applicable payroll taxes and withholding. IRC §3402(d)

In the case where the outside party selects and distributes the award directly to a UA employee without any direction or decision making from UA personnel, the award is income to the recipient but UA would not be responsible for payroll taxes and withholding. The outside party is required to furnish a Form 1099-MISC to the recipient for a calendar year if the total awarded to that individual in that year has a value of $600 or more.

Processing

As a general rule cash awards to employees must be processed through Payroll so that taxes can be withheld.

For any other gifts/prizes/awards to employees, we ask that departments use the Taxable Fringe Reporting Form to submit information to the Tax Office for review. If the item is taxable, the Tax Office will submit information to Payroll for tax withholding. Generally, the employee will have tax withholding taken in the next pay period(s) after receiving a taxable gift/prize/award.

Immigration Fees

Immigration-related fees may be considered ordinary and necessary business expenses of the University (nontaxable), or personal expenses of an employee (taxable), depending on the circumstances.

Business (Nontaxable)

Immigration fees incurred for the express purpose of permitting an individual to enter or remain in the U.S. to work at the University, are considered primarily related to the business of the University. As noted by U.S. Citizenship and Immigration Services (USCIS), the purpose of these applications is to serve the employer’s labor needs; therefore, the employer is considered the petitioner and must pay the related fees. As these costs are ordinary and necessary business expenses of the University, they are not considered taxable income to the employee.

EXAMPLES of costs that are nontaxable to the employee if paid by UA:

- Fees for employer-specific visas such as J, O, and TN

- Required employer fees for H-1B petition or extension

- Employment-based permanent residency petition (Form I-140)

Personal (Taxable)

Immigration fees, legal fees and other costs associated with obtaining Lawful Permanent Resident (LPR) status (i.e. obtaining a green card) are not incurred primarily for the University’s business. LPR status is not employer specific and provides a personal long-term benefit to the individual to work for other employers. The University may agree to sponsor and assist a recruit in obtaining LPR status. The provision of such benefit may be viewed as a recruiting expense of the University along the lines of granting a signing bonus. Signing bonuses are always wages. Thus, expenses and reimbursements designated for applying for and obtaining LPR status are considered as wages when paid on behalf of the recruit.

EXAMPLES of costs that are taxable to the employee if paid by UA:

- Green card application fee (Form I-485)

- Optional premium processing fee for green card (Form I-907)

- Attorney fees associated with green card application

- Physical examinations or other personal costs required for green card application

- Any filing fees, legal or other costs for dependent family members

Processing

To the extent departments pay for any fees associated with applying for and obtaining LPR status, or any fees for dependent family members, the amount of the benefit provided should be reported to the Tax Office using the Taxable Fringe Reporting Form. This process should be followed regardless of whether the payment is made to a government entity, an outside law firm, or as a reimbursement to the employee.

The Tax Office will review and forward information to Payroll so that taxes can be withheld in a timely manner. Taxation may be split over multiple pay periods within the calendar year, in order to reduce the tax impact in any one pay period. For questions regarding the taxability of immigration-related fees, please contact us at payrolltax@ua.edu.

Lodging

The value of employer-provided lodging will be excluded from the employee’s gross income per IRC §119 if the following three requirements are met:

- the lodging is furnished on the business premises of the employer;

- the lodging is provided for the convenience of the employer; and

- the employee is required to accept the lodging as a condition of employment.

The failure to meet any one of these conditions will render this exclusion inapplicable, thereby causing the value of the housing to be included in the employee’s income. Reg. §1.119-1(b)

Housing allowances are not excludable from income. If an employee is given a choice between living in certain employer-provided housing and receiving a cash allowance , then the housing is not excludable from the employee’s income even if the employee accepts the housing in kind. Reg. §1.119-1(e)

The phrase “on the business premises” has been construed as meaning: (1) living quarters that constitute an integral part of the business property; (2) a place where the employee performs some significant portion of his duties; and (3) premises on which the employer carries on a substantial segment of its business activities. The lodging should be “unified functionally with the educational goals and business of activities” of the University. (Winchell, Richard v. U.S., (1983, DC NE) 52 AFTR 2d 83-5222)

The “convenience of the employer” and “condition of employment” tests are essentially equivalent. Both tests required a direct connection between the lodging provided and the business interests of the employer that are served by the employee utilizing the lodging. BENNINGHOFF, RONALD W. v COMM., 45 AFTR 2d 80-1646, (CA5, 3/21/1980).

Further, the “condition of employment” test requires the employee to accept the housing in order to enable him to properly perform the duties of his employment or to be available for University business at all times. Reg. §1.119-1(b) The employer’s requirement or insistence that an employee accept the lodging, is not sufficient to meet the condition of employment test. The lodging must be necessary for the employee to perform his/her job duties. The job duties must be clearly defined in the employee’s position description or contract, in order to document that this test is met. In addition, the duties must be essential to the position, not merely incidental, in order to qualify.

Resident Advisors

The value of lodging furnished to Resident Advisors (RAs) is excludable from gross income if the three requirements are met.

If the RA is compensated in addition to receiving the lodging, then the compensation is included in taxable income. If the RA is given an option to choose between receiving an allowance or the lodging itself, then the amount is not excludable from wages. IRC §119

Valuation

For University-provided housing that does not meet the requirements above to be excluded from income, valuation will be determined as follows:

Qualified Campus Lodging – IRC §119(d)

This provision limits the amount of housing benefits that will be included in an employee’s gross income to 5% of the housing’s appraised value. To qualify for the 5% limitation, the housing must be “qualified campus lodging,” defined as housing that is:

- Located on, or in the proximity of, a campus of the educational institution, and

- Furnished to the employee for use as a residence.

Other Lodging

If the University-provided housing is not considered “qualified campus lodging”, the fair market valuation will be used. For example, if the University is renting an off-campus apartment for the employee’s use, the monthly rental value will be included in the employee’s income as a taxable benefit.

EXAMPLES: Following are a few examples of housing that UA departments have provided to employees. This is not an all-inclusive list, but is intended to alert departments to potential situations that should be reported to the Tax Office.

- Capstone Village

- Housing and Residential Communities (dorms or apartments)

- Off campus apartments such as The Reserve, The Lofts, and others

- Rental/lease payments for an off-campus house

- Housing allowance in special circumstances

Processing

Please use the Taxable Fringe Reporting Form to submit information to the Tax Office when you are making arrangements to provide housing for an employee. The Tax Analyst will review and contact the department/employee regarding the amount and timing of the benefit. If needed, the taxable benefit may be split over multiple pay periods. Once determined, the Tax Office will forward the taxable value to Payroll so that taxes can be withheld from the employee’s paycheck(s). For questions about the taxability of housing, please contact the Tax Office at payrolltax@ua.edu.

Meals

Meals Provided for the Convenience of the Employer – IRC §119

The value of employer-provided meals shall be excludable from income if the meals are

- furnished on the business premises of the employer, and

- furnished for the convenience of the employer.

“On the business premises” generally means the place of employment. Reg. §1.119-1(c)

Meals will be treated as furnished for the convenience of the employer if such meals are provided for non-compensatory business reasons. Reg. §1.119-1(a)(2)

EXAMPLES of meals furnished for non-compensatory business reasons include:

- The meals are furnished during working hours to have the employee available for emergency call during his meal period;

- The meals are furnished during the employee’s working hours, because the employee’s meal period is restricted to 30 or 45 minutes, AND the employee could not be expected to eat elsewhere in such a short meal period;

- The meals are furnished during the employee’s working hours, because the employee could not secure proper meals within a reasonable meal period (i.e., insufficient eating facilities in the vicinity of the employer’s premises).

- The meal is provided immediately after working hours for substantial non-compensatory reasons, and the employee would have been furnished a meal except that his/her work duties prevented him/her from obtaining a meal during working hours.

Resident Advisors

If lodging in the dormitory is required as a condition of employment, then the RA may exclude the value of any meal furnished without charge to him/her on the University’s premises. Refer to section on Lodging.

Business Entertainment Meals – Reg. §1.274-2(c) and (d)

Properly substantiated business entertainment meals are not taxable to the employee. Refer to Section 1.5 of the UA Spending Policy for details on allowable expenditures and required documentation for business entertainment.

De Minimis Meals – IRC §132(e); Reg. §1.132-6

Infrequent meals of minimal value may be excludable as a de minimis fringe benefit.

Meals are also discussed in the sections on Relocation/Moving and Spouse/Companion Travel.

For situations that are not addressed herein, please contact the Tax Office for review and assistance by emailing payrolltax@ua.edu.

Per Diem for One-Day Trips

Per diem allowances for travel not requiring an overnight stay will be treated as taxable income to the employee.

In order for a reimbursement of an expense for business travel to excludable from income, the individual must travel “away from home” in the pursuit of business on a temporary basis. “Away from home” has been interpreted by the U.S. Supreme Court to require an overnight stay. Merely working overtime or at a great distance from the individual’s residence does not create an exclusion for reimbursements for travel expenses if the traveler returns home without spending the night or stopping for substantial “sleep or rest.”

U.S. v Correll, 389 U.S. 299, 302-303 (1967); Revenue Ruling 75-170; Revenue Ruling 75-432

Whether the trip is in-state or out-of-state is not relevant; if it is a one-day trip, the above taxation rule will apply.

Processing

Per diem allowances for one-day trips are entered into Concur using the following expense account codes:

Partial Day Per Diem – 6-12 Hours (IS or OS) – 72610

Partial Day Per Diem – 12+ Hours (IS or OS) – 72611

The Tax Office will obtain data based on the above expense accounts, and will forward the information to Payroll for taxation on a monthly basis. Generally, tax withholding will occur in the following month after the per diem allowance was paid to the employee.

Personal Use of University Facilities

Recreational Facilities

University recreational facilities are considered a service that UA provides to students/customers in the ordinary course of business. Therefore, there are two potential exclusions that may apply:

- No Additional Cost Exclusion – IRC §132(b); Reg. §1.132-2

This exclusion will apply if the University incurs no substantial additional cost (including foregone revenue) in providing the service to employees. This will generally be true so long as general membership in the facility is not limited due to capacity.

- Qualified Employee Discount Exclusion – IRC §132(c); Reg. §1.132-3

This exclusion will apply if the employee discount does not exceed 20% of the regular price charged to customers for membership/use of the facility. However, even if the discount exceeds 20%, the University can rely on the no additional cost exclusion above.

Vacation, Retreat, or Camping Facilities

An employee’s personal use of such facilities, even for a few days, will not qualify as a de minimis fringe benefit, and no other fringe benefit provisions apply to allow the employee’s personal use to be excluded from gross income. Therefore, an employee must recognize gross income to the extent of the value of any personal use of such facilities. IRC §132(e); Reg. §1.132-6

EXAMPLE: As a door prize at the annual health fair, an employee wins a free weekend stay at the University-owned lake house, Boone Cabin. The value of this prize is taxable income to the employee.

Processing

If your department plans to provide an employee with the use of vacation, retreat or camping facilities for personal use, please use the Taxable Fringe Reporting Form to notify the Tax Office, so that the appropriate tax treatment can be applied. Tax withholding will be taken from a subsequent pay period after the benefit is provided.

Relocation / Moving Expenses

IMPORTANT NOTICE—PLEASE INFORM ALL NEW HIRES OF THESE CHANGES:

The Tax Cuts and Jobs Act eliminated the non-taxability of qualified moving expenses. All moving expenses are now taxable to employees if reimbursed or paid on their behalf. The TCJA also eliminated the deduction (on a tax return) for qualified moving expenses effective January 1, 2018. No deductions, whether previously deductible or not, can be made for moving expenses.

Due to this federal law change, the University of Alabama has adopted a Moving Allowance policy. If a department wishes to pay an amount towards relocation costs for a new hire, this will be paid as a taxable moving allowance. The new employee’s offer letter should include a section detailing the amounts and timing agreed to for the payment of the moving allowance.

There are two options for the timing of moving allowance payments:

- Prior to Employment Start Date: If the moving allowance is preferred prior to start date, the moving allowance payment will be processed through Accounts Payable using the Concur Invoice Payment Request with account code 78147 – Moving Allowance. No taxes will be withheld at the time of issuance; however, the applicable taxes will be withheld from one or more paycheck(s) once the employee is active on Payroll. Additionally, the agreed-upon offer letter must be submitted as documentation.

- After Employment Start Date: The moving allowance will be processed through Payroll using an ePA, subject to federal, state, and FICA tax withholdings on the supplemental payroll after employment begins. A copy of the offer letter and/or the Approval Request for Relocation Allowance form (found below) should be submitted as documentation.

Temporary living allowances are available to be made separately from the moving allowance. These are intended to assist with the costs of living once the employee has relocated. This will be processed through Payroll using an ePA with applicable taxes withheld on the regular paycheck(s).

Interview trips are not intended to be covered under a moving allowance. Interview trips prior to acceptance of the position should be paid for by the department or reimbursed to the prospect as nontaxable travel reimbursements.

House-hunting trips are intended to be covered under a moving allowance. There should not be a separate reimbursement or payment for these costs. House-hunting trips were taxable under the old law and are still taxable under the new law.

For more information, please visit the following websites:

A/P Relocation Allowances: http://accountspayable.ua.edu/relocation-allowances/

A/P Spending Policy, Section 9.0 Relocation/Moving Expenses: http://accountspayable.ua.edu/spending-policy/#Relocation

Concur: https://concur.ua.edu/

HR Forms website: http://hr.ua.edu/policies-and-forms – select Relocation Allowance Request Form to access the fillable form.

Questions?

Questions about the payment of moving allowances prior to the employment start date should be directed to Accounts Payable at acctspay@ua.edu or 348-7377.

Questions about the payment of moving allowances after the employment start date should be directed to Human Resources at hrsvctr@ua.edu or 348-7732.

If you have any questions about the taxability of moving allowances, please contact the Tax Office at payrolltax@ua.edu.

Spouse/Companion Travel

As a general practice, travel expenses, including but not limited to transportation, lodging, meals, or registration fees, for spouses or companions are not allowable on University funds. However, in some cases approval may be granted to pay these expenses from a foundation account. Refer to Accounts Payable for guidance on allowable expenditures, funding sources, etc.

The value of travel provided for an employee’s spouse, dependent, or other accompanying individual is generally taxable income to the employee.

A possible exclusion exists as a working condition fringe benefit, if both of the following conditions are satisfied, per Reg. §1.132-5(t):

- it can be adequately shown that the spouse’s, dependent’s, or other accompanying individual’s presence on the employee’s business trip has a bona fide business purpose, and

- the employee substantiates the travel.

IRS rulings and regulations have taken a narrow view of what qualifies as a bona fide business purpose. The purpose of the spouse’s travel must be to serve the business interests of the University in a substantial way. The spouse’s business activities conducted on the trip must be more than incidental; typing notes and attending luncheons and dinners have been held to be incidental. Revenue Ruling 56-168; Reg. §1.162-2(c)

Substantiation of the travel expenses must be done by the employee following the guidelines under Reg. §1.132-5(t) and IRC §274(d). These guidelines require the following questions to be answered and documented:

- the amount of each expense, the date and time of each expense,

- the location of the expense,

- the business reason for the expense, and

- the business relationship of persons involved pertaining to the expense.

If these requirements are not satisfied, the employee will be denied the benefit exclusion.

If the accompanying individual’s travel does not qualify as business, the employee’s taxable fringe benefit is the increase in cost over what the cost would have been if the employee traveled alone. Revenue Ruling 56-168

EXAMPLES of taxable items for a spouse, companion, dependent or other accompanying individual:

- Extra hotel costs (such as an extra room, meals charged to the room, any additional charges attributable to the accompanying individual)

- Commercial airline ticket for the accompanying individual

- Meals or per diem for the accompanying individual

Processing

Departments should use the Taxable Fringe Reporting Form to notify the Tax Office when making arrangements for spouse/companion travel; for example, at the time of booking a flight. In addition, the Spousal Travel – 72625 expense account code should be used for these transactions. Tax withholding will be taken in a subsequent pay period after the spousal travel charges are processed.

Tickets

As a general rule, complimentary or discounted tickets to athletic and/or entertainment events would be considered a taxable fringe benefit. However, exclusions may apply in certain cases as follows:

No Additional Cost Exclusion – IRC §132(b); Reg. §1.132-2

If a home athletic game or campus event has excess capacity or unsold tickets, the value of tickets given to UA employees may be excludable from income under the “No Additional Cost” rule.

Qualified Employee Discount Exclusion – IRC §132(c); Reg. §1.132-3

A UA employee can receive a maximum 20% discount on the face value of a ticket to a home athletic game or campus event for use by the employee. Under the Qualified Employee Discount Exclusion, the 20% discount is excluded from taxable income as a non-taxable fringe benefit. This does not apply to “away” games or events.

For home games, there is no direct cost for UA to obtain the event ticket; it is considered a service that the employer offers for sale to customers in the usual course of its business.

For away games, there is a direct cost for UA to obtain the event ticket since we must pay the opposing teams’ school or venue for the event tickets. A complimentary ticket will be taxable to the employee at face value as a taxable fringe benefit.

Working Condition Fringe Exclusion – IRC §132(d); Reg. §1.132-5

If an employee receives a ticket to attend a game/event in a working capacity, the value of the ticket may be excluded as a working condition fringe benefit. This exclusion may apply if the employee is required to entertain individuals who have a business relationship with the University. The exclusion would not, however, exclude the value of any tickets that are used to entertain the employee’s spouse, family members, or personal acquaintances. Also, in order to qualify as a working condition fringe benefit, the employee must maintain adequate records showing that the tickets were, in fact, used for business purposes.

De Minimis Fringe Exclusion – IRC §132(e); Reg. §1.132-6

Occasional tickets to home athletic games or campus events (not season ticket packages) may be excluded from income as a de minimis fringe benefit.

Processing

Depending on the area, ticket taxation may be handled in several ways:

Athletic complimentary season ticket packages are provided to Athletic Department staff – These are tracked by the Athletic Ticket Office and information is submitted to Payroll on a monthly basis for taxation. Taxation generally occurs in the following month after the games have been played. For example, the portion of the complimentary season ticket package of games played in October would be taxed in the November payroll.

Athletic ticket inventory – For UA department and foundation purchases of athletic ticket inventory, refer to the Athletic Ticket Inventory Guidelines and the Athletic Ticket Inventory Reconciliation form, found on the Financial Accounting and Reporting website. These procedures are used to document the use of tickets, including personal use that would be taxable to the employee. This information is to be completed on a monthly basis, so that the Tax Office can process taxable items in a timely manner.

For other complimentary tickets, UA departments are encouraged to use the Taxable Fringe Reporting Form to submit information to the Tax Office as events occur. For questions, contact us at payrolltax@ua.edu.